After paying an MLB-high $36.2 million for exceeding the luxury tax threshold in 2017, the Los Angeles Dodgers have kept their payroll below the competitive balance tax line in each of the past two seasons.

From 2014-17, the Dodgers were tabbed with the highest luxury tax bill, and they paid nearly $150 million in taxes when also including 2013. L.A. reset penalties by remaining below the threshold for 2018, which set an expectation they would be a factor in free agency last winter.

The Dodgers pursued Bryce Harper — albeit attempting to entice him with a short-term contract — but ultimately only signed Joe Kelly and A.J. Pollock to what many perceived as inflated deals.

Despite regularly declining there was any sort of mandate or goal to accomplish as much, the Dodgers again were below the competitive balance tax in 2019. They did make an aggressive bid to sign Gerrit Cole, but weren’t on the radar of Anthony Rendon and Stephen Strasburg.

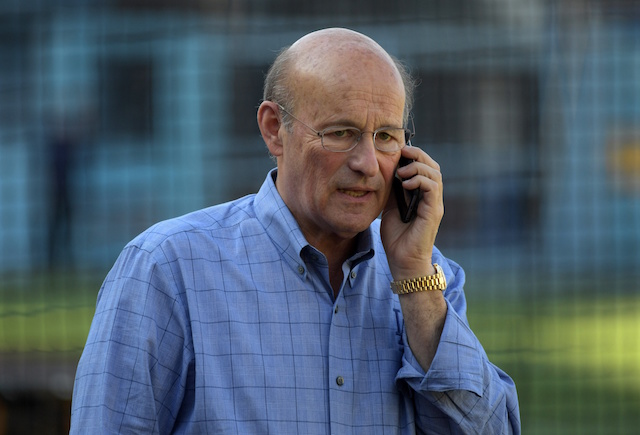

Although they currently project to fall below the luxury tax threshold this season, Dodgers president and CEO Stan Kasten predicted the team will exceed it, per Bill Plaschke of the L.A. Times

“The team we have now is not going to be the team we have to start the postseason,” Kasten said. “I expect that team, this year, it looks like it’s going to be well over the CBT, or somewhat over.”

Including arbitration projections and other figures, the Dodgers’ payroll is tracking to finish at roughly $165 million; the threshold for 2020 is set at $208 million.

The Dodgers could exceed that mark in one fell swoop if they were to acquire Mookie Betts and David Price in a trade with the Boston Red Sox. A potential deal has been speculated about for several weeks, and in particular since the Dodgers failed to make a splash in free agency.

A club exceeding the competitive balance tax threshold for the first time must pay a 20% tax on all overages. If a team exceeds it for a second consecutive season, that figure rises to 30%, and three or more straight seasons of exceeding the threshold comes with a 50% luxury tax.

Furthermore, clubs that exceed the threshold by $20 million to $40 million are also subject to a 12% surtax, those who exceed it by more than $40 million are taxed at a 42.5% rate the first time and a 45% rate if they exceed it by more than $40 million again in following year(s).

Beginning in 2018, clubs that were $40 million or more above the threshold shall have their highest selection in the MLB Draft moved back 10 places unless the pick falls in the top six. In that case, the team will have its second-highest selection moved back 10 places instead.

Have you subscribed to our YouTube channel? It’s the best way to watch player interviews, exclusive coverage from events, participate in our live shows, and more!